Partner Program Overview

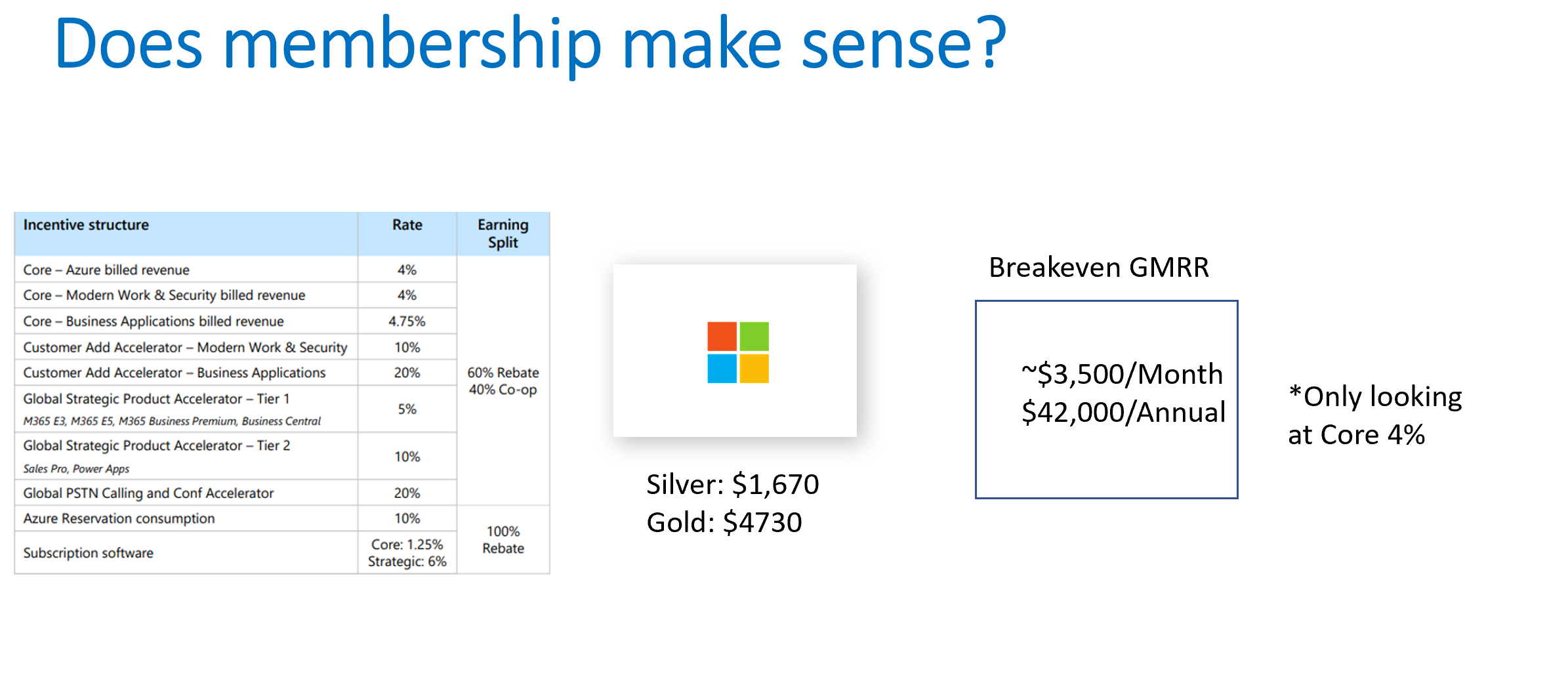

If you are an MSP doing at least $3500/month (4,680 AUD) in gross revenue from Microsoft, then you should keep reading. Not many MSPs are taking the full advantage of Microsoft’s partner program. The program can be lucrative but is hard to navigate because of the rebate structure and the enrollment process. In this article, I will be breaking down the FY21 incentive structure from Microsoft and showing you how you could potentially gain an additional 30-50% return on your NMRR (net monthly recurring revenue). This article is primarily made to show you if the cost of a silver or gold membership makes sense with the current business you are doing now. If so, there will be a follow-up article showing you how to complete the enrollment process. First, lets take a look at the incentive structure:

Confusing right? Not only do we have to navigate what products fall under these rows like “Modern Work & Security billed revenue” but we also then have to calculate this earnings split. I will be breaking down what is in each section and giving you some key highlights that you need to know in order to successfully calculate your potential payouts. Please reference the following resources to see the approved product list from Microsoft and the full incentives breakdown.

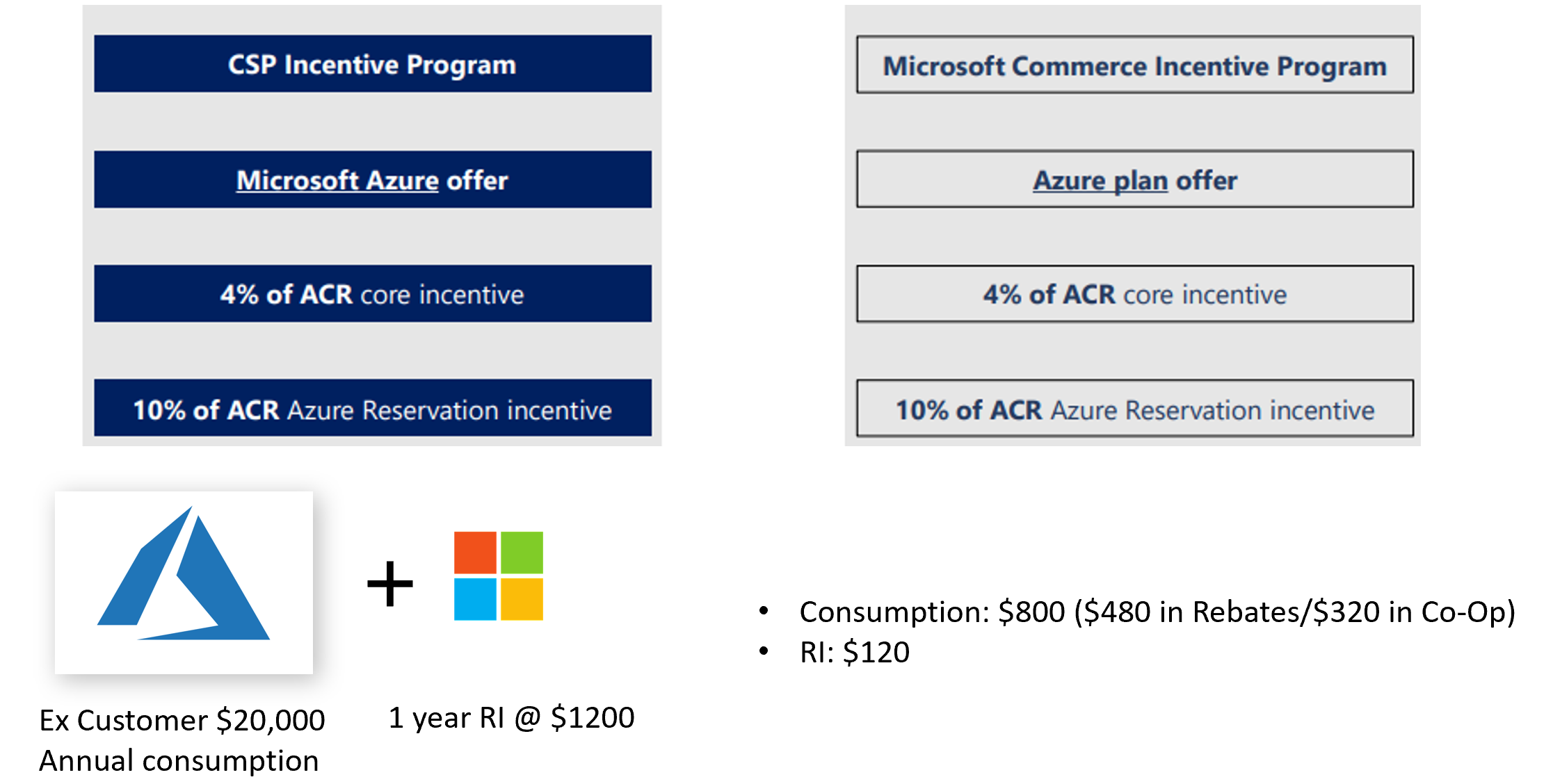

Azure Opportunities

- Core-Azure Billed revenue

- Azure Reservation Consumption

Essentially core azure billed revenue is just all of the billable usage going on in subscriptions. There is a 4% rebate associated to this and is subject to the split with co-op funds.

Azure reservations are given the 10% rebate for your annual spend. If you purchase a 3-year RI then you would be eligible for 10% of the spend in the year it was purchased.

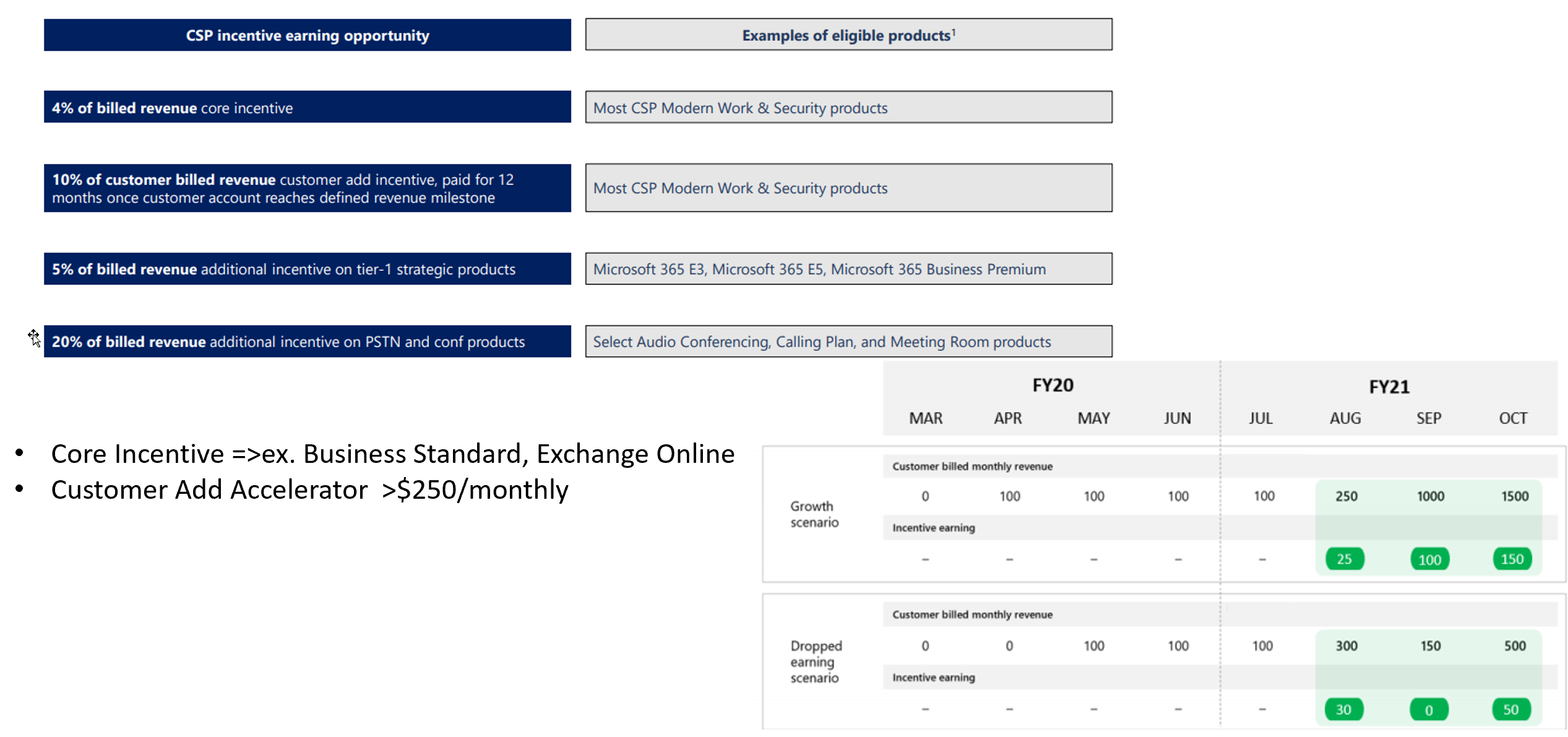

Modern Work and Security

The core incentive for modern work and security can be thought of as any base plan that you are used to. This includes business standard, exchange online, business premium, etc. As an MSP, it is almost guaranteed that you are going to be eligible for this 4% rebate. On top of that they do provide an ADDITIIONAL 5% if you are selling the strategic products that they reference in the table above.

The customer add accelerator pertains to customers that have recently crossed into $250 of spend in the past 12 months. When they cross this threshold, you are eligible for 10% of the total spend (in GMRR) each month. The diagram above shows a customer who moves from $250 spend to $1000 to $1500. The payouts are listed underneath. If that same customer drops below $250, they are not eligible the next month.

The last incentive is for PSTN and conferencing products. These are add-on product to a subscription like E3. These aren’t as popular in the MSP space but they do provide a 20% kick back.

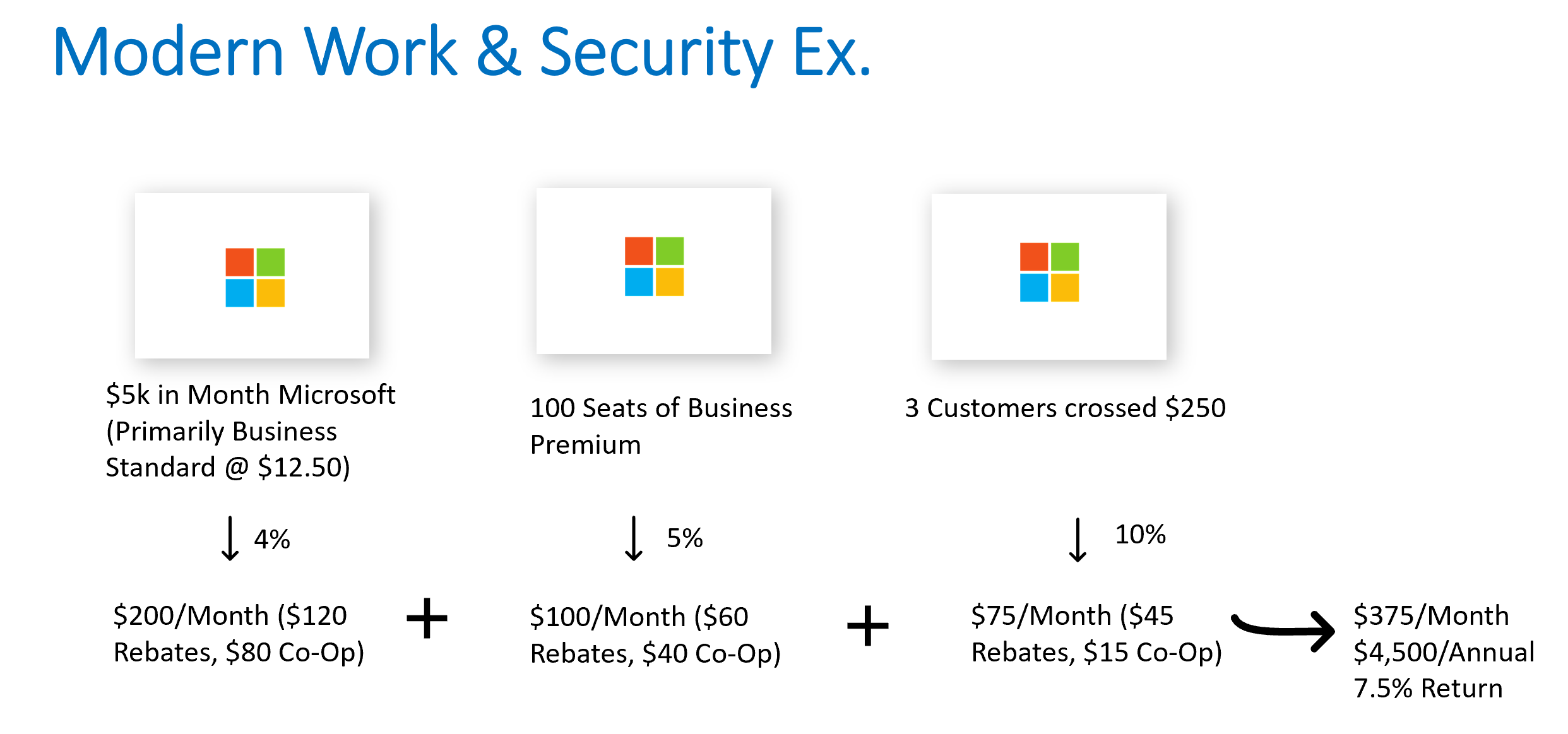

In the following example, we have 5k in monthly GMRR that is primarily made up of Business Standard licensing. We then also have 100 seats of BP which is eligible for the additional 5%. We also have 3 customers that recently crossed the $250 threshold which are now eligible for the additional 10%. Altogether this provides up an additional 7.5% return on GMRR.

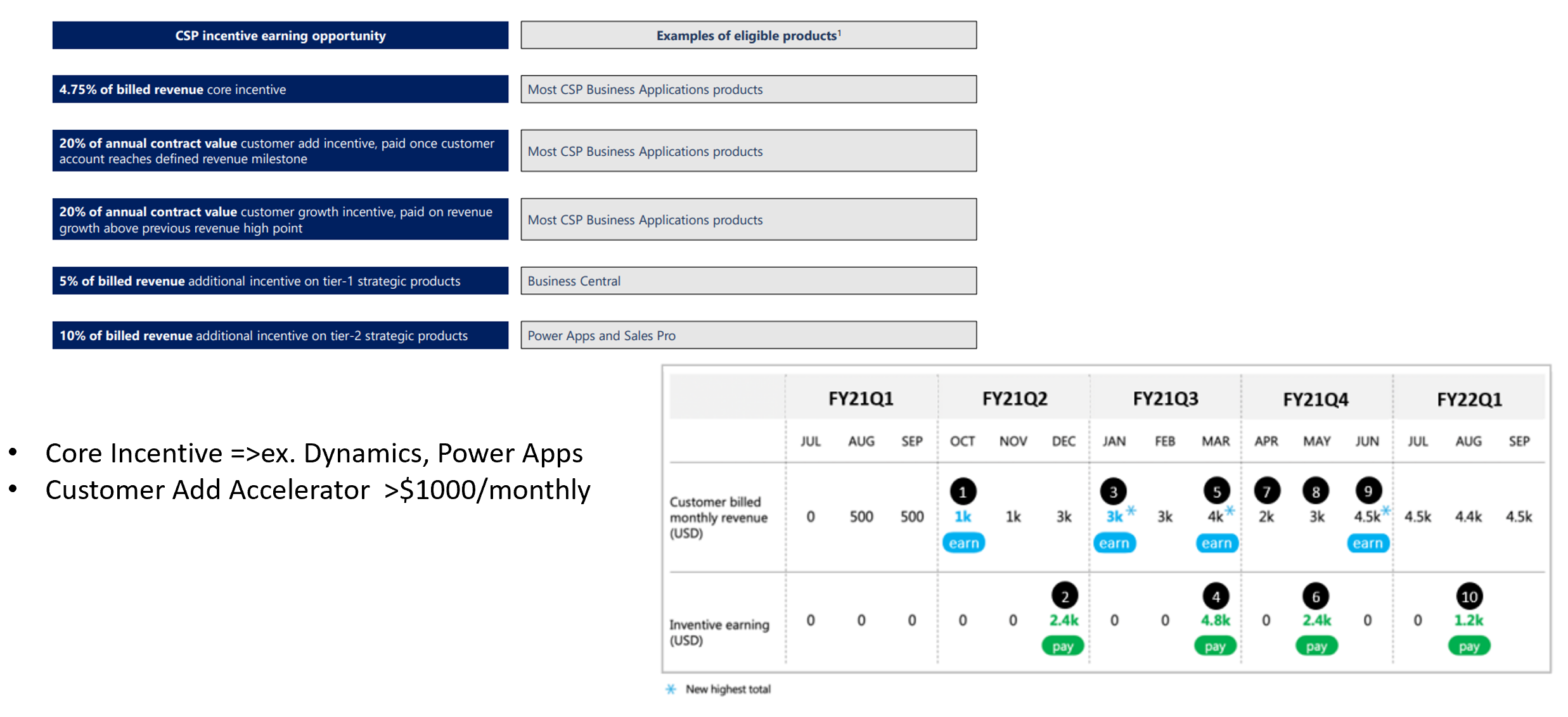

Business Application Opportunities

If you take a look at Microsofts chart for what is considered eligible for business application rebates, you will find that it is primarily Dynamics and PowerApps. These are the products eligible for the core incentive of 4.75%. Additional rebates are available if you are selling Business Central, Power Apps, and Sales Pro (Dynamics sku).

They have a customer add accelerator which customers become eligible for if they cross $1000 in spend monthly FOR THESE PRODUCTS. These could be highly lucrative as they do pay out 20% of the annual contract value and 20% of incremental growth on this as well. In the diagram you see that the example customer reaches 1k of spend in October and the MSP is paid out 2.4k in December (1k * 12 months * .20%). From there they customer reaches 3k in spend in January. The MSP is paid out the incremental growth of the annual contract at the end of that quarter.

Again, this one gets much more confusing but if you are starting to ramp customers into Dynamics right now, you should definitely take the time look into this incentive structure.

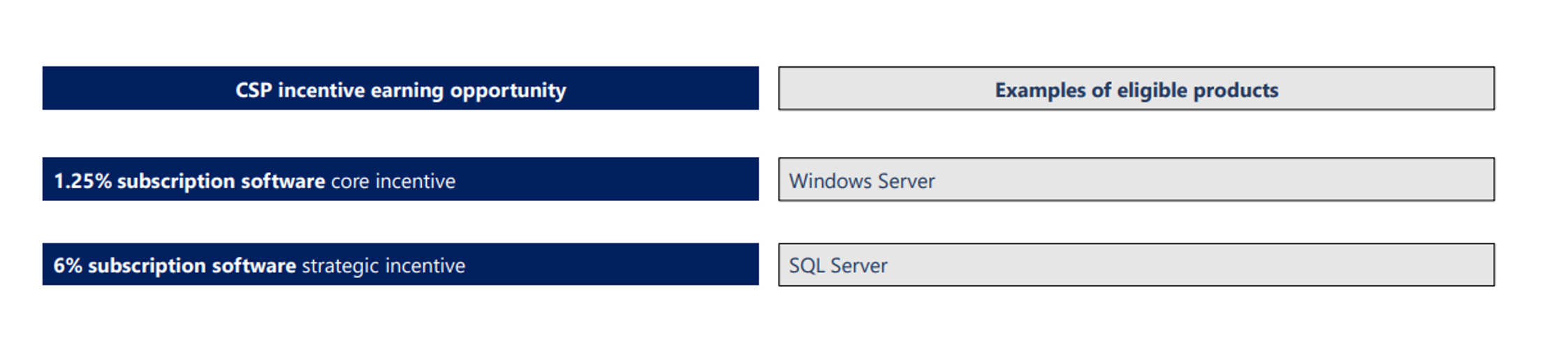

Software Opportunities

This one is pretty straightforward in that you are eligible for rebates if you sell software licensing. Common examples are provided for Windows Server and SQL Server.

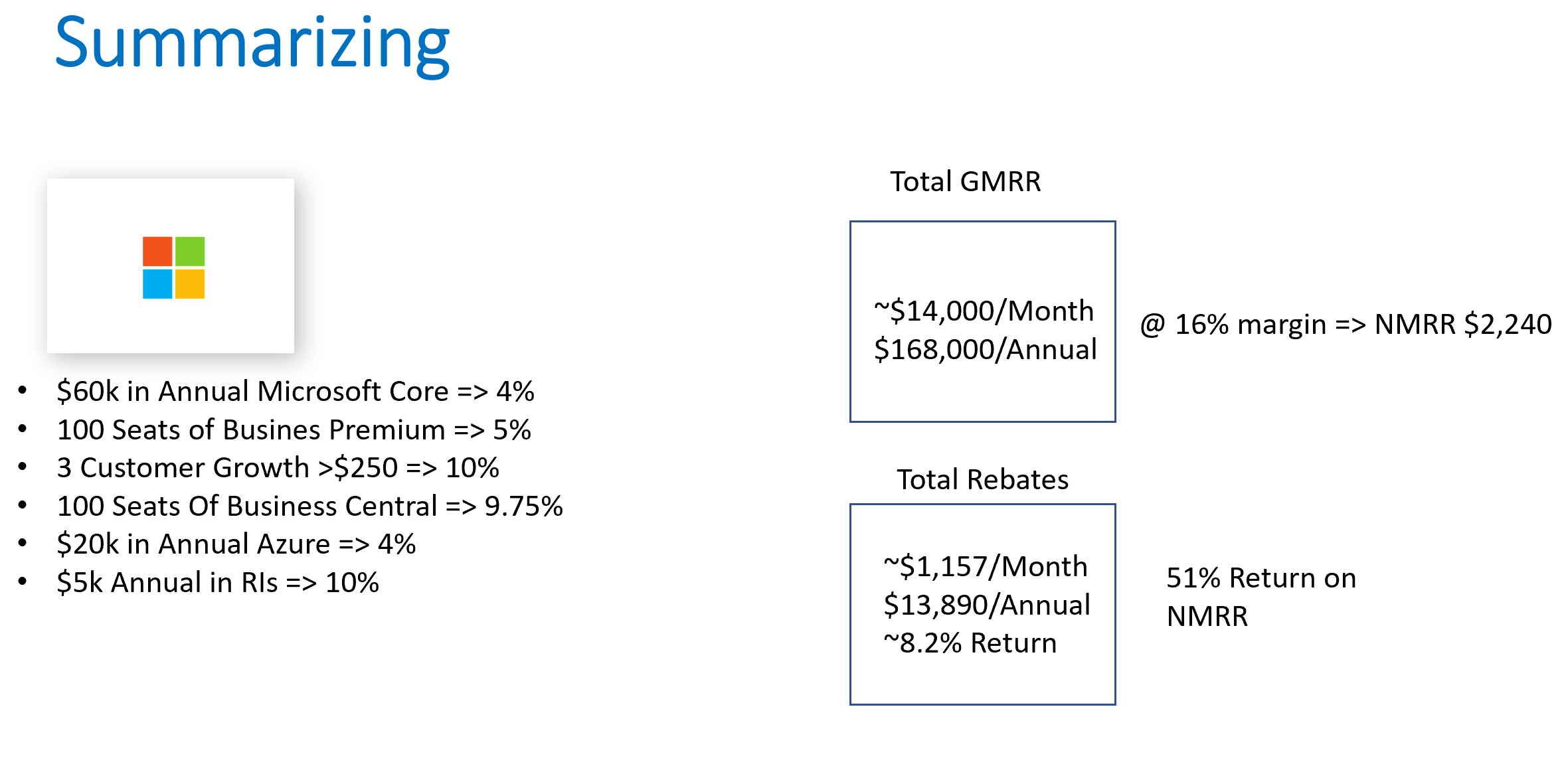

To summarize here, I made an example of an MSP taking in 60k annually in gross Microsoft revenue from core subscriptions. They are also eligible for other pieces of the incentive structure due to having strategic products, Azure subscriptions, and RIs. In this case they are receiving 16% margin from a distributor which equates to about $2,240 in NMRR. With the eligible rebates, they would be looking at receiving about $1,157/month which is a 51% return on their NMRR.

Putting this all together, I wanted to find the breakeven point where membership fees make sense. Keep in mind that the membership offering includes more than just rebates. You are also eligible for free licensing that you can use internally. The cost of a silver membership is $1,670 and a gold membership is $4,730. With that in mind, your breakeven ONLY LOOKING AT THE CORE INCENTIVE OF 4% is approximately $3500 in GMRR per month in Microsoft. Again this is subject to looking at the most basic level. You might have licensing which reflects the higher rebates so your breakeven might be lower. If you sell a lot of Business Premium and Dynamics today, then this is most likely the case.

Microsoft has a spreadsheet you can use to help you calculate your anticipated payout. This resource along with all resources they have available for incentives can be found here. I hope this article provided some targeted audience on the partner program. If you feel like this makes sense for your company to do, please check out my follow up article on registering for incentives.